Source: AdobeStock

Cryptocurrency examiner Songbird Davis has anticipated that Ethereum will reach a cost of $15,000 per coin within the up and coming bull cycle of 2024-2025.

In spite of the asset’s generally stifled execution this year, Davis predicts a critical rise that seem possibly surrender significant picks up for speculators.

In a video distributed on X on December 25, Davis clarified that the expected surge would not be activated through buying, offering, or staking but or maybe through Ethereum layer-2 resources.

The YouTuber too dove into the current and up and coming layer-2 postings, counting zkSync, Starknet, Linea, Scroll, Impact, Manta, and Celestia. He highlighted the potential for short-term benefits related with these modern postings.

Whereas recognizing the verifiable pump-and-dump designs watched in recently propelled tokens, Davis pointed out occurrences where tokens picked up critical footing after being recorded on major trades.

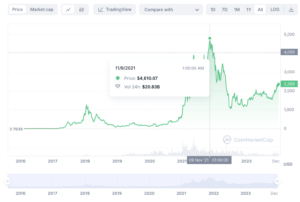

In spite of showing potential openings, Davis advertised a cautious viewpoint for Ethereum in 2024. Drawing comparisons with authentic picks up, he anticipated considerable development in case Ethereum reproduces or somewhat outperforms its past cycle’s highs, which come to around $4,800 in November 2021.

Source: CoinMarketCap

Taking after its all-time tall, ETH experienced a outstanding 81% decrease amid the bear cycle, coming to its most reduced point at $880 on June 18, 2022.

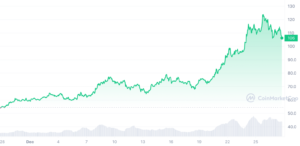

Along these lines, Ethereum set out on a recuperation direction, transcendently showing an upward slant all through 2023. This finished in a essential tall of $2,400 on December 9 and a press time cost of $2,367.

Source: CoinMarketCap

Be that as it may, Davis cautioned that people entering the showcase at the current Ethereum cost may as it were involvement noteworthy picks up in case they make considerable ventures.

SOL Balanced to Be the Way better Resource

The cost of SOL, the local cryptocurrency of the smart-contract-enabled layer-1 Solana blockchain convention, has surged essentially, outperforming the $118 stamp and coming to its most elevated esteem in eighteen months. As of December 27, the asset’s cost stood at $108.59.

SOL 30-Day Advertise Information

This striking uptick coincided with a surge in gas expenses inside the Ethereum environment, where exchange costs briefly spiked over $10. A few clients indeed detailed expenses as tall as $150 for exchanges worth as it were $50 on the Ethereum blockchain.

In spite of the fact that Ethereum gas expenses have since diminished by 50% from the week’s crest, clients have effectively investigated elective blockchain stages with lower exchange costs, driving to expanded action on Solana.

Messari’s December 14 report assist highlights a amazing 400% increment in dynamic addresses on Solana within the final three months, compared to Ethereum’s 3%.

Solana’s request is underscored by its reliably moo expenses, averaging less than $0.01, concurring to CoinCodex’s later report.

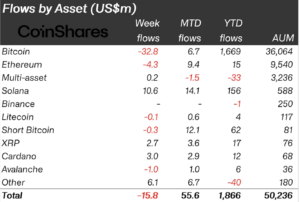

Besides, the stage has recorded a positive drift in support streams. Solana-based venture funds attracted $10.6 million within the week finishing December 16, outperforming inflows into major resources like Bitcoin and Ethereum.

Source: CoinShares Stores Stream Information

In December alone, Solana stores saw inflows of $14.1 million, stamping the most noteworthy within the cryptocurrency division. Right now, SOL’s directions outpace those of ETH, proposing its potential as a predominant resource for a critical surge within the up and coming bull run another year.

In any case, this quick climb prompts a vital address inside the crypto community: Is the surprising rise in Solana’s esteem a brief event, or does it check the graduation of a modern time in its showcase dominance?

The reply is laced in a complex interaction of advertise patterns, speculator opinion, and the advancement of the cryptocurrency scene.